Elevance Health (ELV): Analyzing Recent Performance and Future Outlook

Elevance Health, identified by its ticker symbol ELV, has positioned itself as a lifelong health partner dedicated to fostering better health outcomes worldwide. This organization is instrumental in assisting individuals, families, and communities throughout their healthcare journeys.

Recent Performance Metrics

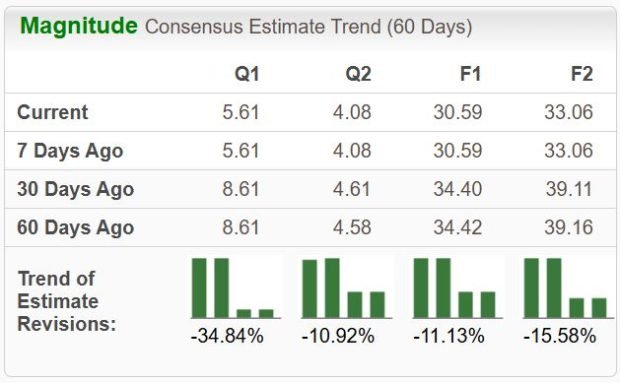

Recent financial disclosures for Elevance Health revealed a disappointing performance, leading to a noticeable decline in stock value after the earnings announcement. The company revised its outlook for the current fiscal year, marking a deviation from previous expectations. Specifically, Elevance Health’s latest earnings per share (EPS) fell below the consensus estimate by over 3%, prompting analysts to reassess the company’s financial trajectory.

In terms of quantitative metrics, the adjusted EPS dropped by 13% compared to the same quarter last year, while total revenue reached $49.4 billion, reflecting a growth rate of 14% year-on-year. However, Elevance Health has signaled caution ahead, projecting an adjusted EPS of $30.00 for 2025, a significant reduction from its earlier guidance range of $34.15 to $34.85 provided shortly after the last earnings report in early May.

Financial Insights

Such a substantial downward adjustment of the guidance, especially so soon after reaffirming previous projections, raises questions about the company’s financial health. The following chart depicts Elevance Health’s quarterly sales performance.

Chart showing quarterly sales would be here.

Market Position and Analyst Sentiment

The recent decline in guidance creates a challenging short-term outlook for Elevance Health’s share price. Analysts currently reflect a notably bearish sentiment, assigning the company a Zacks Rank of #5, indicating a "Strong Sell" recommendation based on the current earnings outlook.

Investors seeking robust stock options might want to consider those with a Zacks Rank of #1 ("Strong Buy") or #2 ("Buy"), which typically demonstrate a stronger earnings forecast along with the potential for significant short-term gains.

Trend in Semiconductor Stocks

In a different market segment, experts have identified a specific semiconductor company that is gaining attention. Unlike major players such as NVIDIA, this lesser-known firm specializes in niche semiconductor products and is strategically positioned to capitalize on emerging growth opportunities in the sector. The semiconductor market is anticipated to experience substantial expansion, with projections indicating a rise from $452 billion in 2021 to a striking $971 billion by 2028.

This company’s trajectory is especially promising due to its focus on areas like Artificial Intelligence, Machine Learning, and the Internet of Things. It is an excellent time to explore investment opportunities in this rising star within the semiconductor industry.

Conclusion

In summary, while Elevance Health is facing considerable challenges reflected in its recent financial results and revised earnings outlook, there are also promising opportunities in sectors such as semiconductors. Stakeholders should remain vigilant and informed as they navigate these evolving landscapes in the healthcare and technology markets.