A recent analysis of broker ratings reveals that Rio Tinto plc (Ticker: RIO) holds the position of the 17th most favored stock among analysts within the Metals Channel Global Mining Titans Index. This index features the leading fifty companies in the global metals and mining industry. It’s important to note that the composition of this index is dynamic, continuously adapting to reflect shifts in the market landscape, including fluctuations in commodity prices, regulatory changes, and general market volatility.

Interestingly, a poor ranking among analysts does not automatically indicate that a stock is destined for underperformance. While lower ranks can signify potential concerns, investors with a bullish outlook may interpret such data as an opportunity for significant growth, viewing underappreciated stocks as having substantial upside potential.

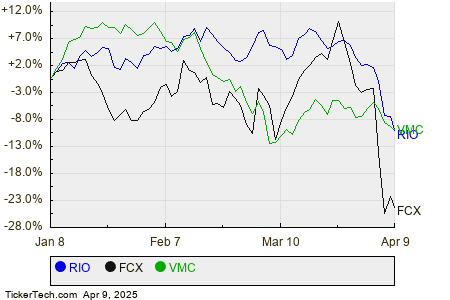

Rio Tinto operates within the Metals & Mining sector, contending with key competitors like Freeport-McMoRan Copper & Gold (FCX), which has experienced a modest increase of around 1.1% recently, and Vulcan Materials Co (VMC), which has seen a decline of approximately 2.4%. For those examining stock performance trends, a three-month comparative price history chart illustrates the fluctuations of RIO in relation to FCX and VMC.

As of midday Wednesday, Rio Tinto’s stock is up about 0.7%, signaling some positive movement in the market.

When considering investments in the metals and mining sector, it is essential to look at various factors that can influence a company’s performance. Market sentiment, regulatory developments, and global economic conditions can all play crucial roles in affecting stock prices. Active investors should keep a close watch on these variables to make informed decisions.

In the context of investment strategies, diversification within the metals and mining sector is also vital. By understanding how different companies, like FCX and VMC, perform in comparison to RIO, investors can make more strategic decisions that align with their financial goals.

Overall, the dynamics of the Metals Channel Global Mining Titans Index reveal much about the current landscape of the industry. Rio Tinto, with its robust market presence, showcases how companies in this sector can shift in popularity among analysts and traders alike. This ongoing evolution demands that investors remain vigilant, adapting their strategies to navigate the complexities of the market effectively.

For those considering investments in Rio Tinto or similar stocks, keeping abreast of the latest market trends and analyst recommendations can provide valuable insights. This will not only enhance the understanding of individual stocks but will also contribute to a more comprehensive investment strategy focused on the metals and mining domain.

As the markets fluctuate, the performance of companies within the Metals Channel Global Mining Titans Index, including Rio Tinto, will continue to be influenced by a variety of factors. Investors and analysts alike are urged to conduct thorough research and monitor the developments closely to capitalize on potential opportunities.