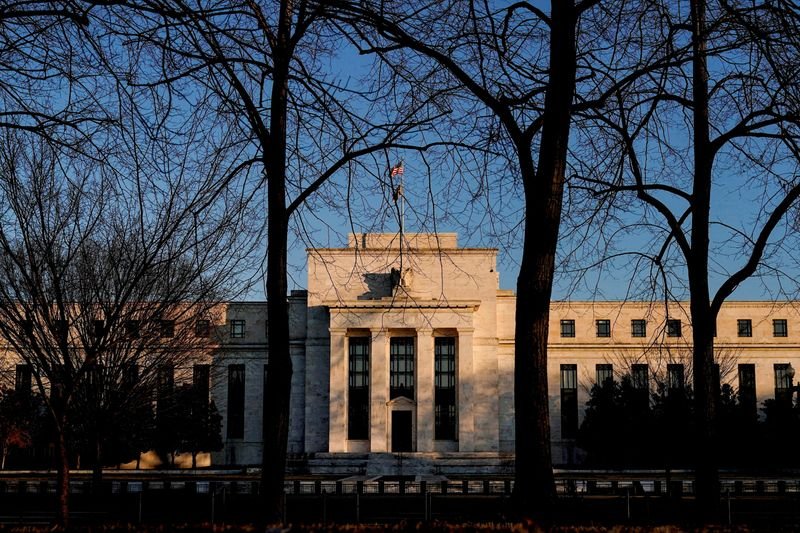

Bond Investors Maintain Neutral Position Before Fed Meeting

As the Federal Reserve’s meeting approaches, bond investors seem to be adopting a cautious and neutral stance. This comes amid concerns regarding interest rate changes and their potential impact on the bond market. Many investors are opting to wait for clearer signals before making significant adjustments to their portfolios.

The current climate reflects a mixture of apprehension and anticipation. With inflation pressures and economic indicators continuously evolving, bond traders are naturally attentive to any hints that might emerge from the Fed. These indicators—ranging from employment statistics to consumer spending—play a critical role in shaping the landscape for fixed-income securities.

Investors are particularly focused on the Fed’s messaging regarding future interest rate policies. The central bank has been vocal about its aim to combat inflation, which has pressured rates higher over the past year. Consequently, bond prices have fluctuated, leading many investors to maintain a neutral outlook and stick to a strategy of holding onto existing positions.

Despite an overall neutral strategy, market participants are closely analyzing yield curves. An inverted yield curve, which occurs when short-term interest rates exceed long-term rates, has historically signaled economic downturns. Such developments contribute to investor caution, as many don’t want to jeopardize their capital ahead of potential market shifts.

For many bond investors, diversification remains a crucial tactic in mitigating risks. Allocating assets across various sectors—such as government bonds, corporate bonds, and municipal securities—can provide a buffer against volatility. This strategy allows investors to benefit from various interest rate environments and enhances overall portfolio resilience.

In addition to traditional bond investments, some investors are exploring newer products. Exchange-traded funds (ETFs) that focus on bond markets are gaining popularity. These funds offer the benefit of liquidity and the opportunity to invest in a diversified pool of fixed-income assets, making them attractive to those looking to manage risk more effectively.

Furthermore, geopolitical events and economic data releases continue to introduce uncertainties into the bond market. Investors are keeping a close watch on developments, as global tensions can influence domestic economic conditions. This interconnectedness means that even local market movements in the U.S. can have wider implications.

Yield expectations have also become a central topic among bond market analysts. Projections regarding future yields depend largely on anticipated actions from the Fed. As interest rates shift, so too do expectations around bond yields, impacting investor strategies. The challenge lies in predicting these changes accurately, prompting bond investors to remain vigilant and ready to adapt.

Amid this complexity, many financial advisors recommend a balanced approach. Investors are encouraged to review their bond allocations regularly and consider their long-term objectives. Being proactive in assessing market conditions can help investors navigate through unfavorable scenarios.

The sentiment in the bond market is one of patience and strategic planning. While maintaining a neutral stance may seem passive, it allows investors the flexibility to respond to changing market conditions as they arise. As the Fed meeting nears, this careful observation and calculated approach will be critical for bond market participants.

In summary, as bond investors brace for the imminent Fed meeting, their neutral position reflects both prudence and an eye on future opportunities. With economic indicators and geopolitical developments continuously evolving, maintaining a careful and diversified bond strategy appears to be the optimal pathway moving forward. Observing these factors will enable investors to make informed decisions while navigating an inherently unpredictable market.

In light of these dynamics, understanding the shifts in bond market trends and adjusting portfolios accordingly becomes paramount. Staying informed and prepared for potential changes will benefit bond investors, helping them successfully manage their investments in this complex environment.