LBMA Market Overview: April 2025 Trading Volumes

Introduction to Market Trends

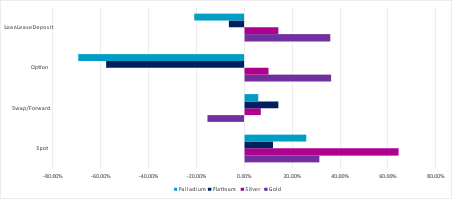

In April 2025, the LBMA reported significant activity in the precious metals market, particularly in gold, silver, platinum, and palladium. The monthly report highlights trading volumes split by categories such as spot, swaps, forwards, options, and various loan products, providing crucial insights into market dynamics influenced by global economic factors.

Gold Prices Surge

Gold reached an unprecedented value of $3,500.10 on April 22, marking a historic high in both nominal and real terms when adjusted for inflation. This shift underscores the metal’s flight to safety during times of uncertainty and economic instability. Historically, gold’s peak in January 1980 stood at $850, which, when adjusted to 2025 dollars, translates to approximately $3,486. These statistics suggest that gold’s current price could signify a peak, driven by ongoing geopolitical tensions and economic challenges.

Market Volumes and Activity

April introduced substantial trading volumes, particularly on significant days following the closure of the London market on Easter Monday. The busiest trading day recorded a turnover of 53.2 million ounces, closely followed by a continuous uptick in spot and loan trading, reflecting heightened investor interest and a shift from equities to commodities. The decline of the US dollar added further momentum to gold prices, prompting movement from investment funds into more stable assets.

Economic Influences

Despite gold’s recent highs, the silver and platinum group metals (PGMs) faced downward pressure. Economic fears related to a potential recession in the U.S., uncertainty in Europe, and low consumer confidence in China contributed to subdued performance in these markets. For instance, several automotive companies adjusted their earnings outlooks, indicating that the economic landscape remained volatile.

Currency Movements and Market Correlations

The interplay between the U.S. dollar, Treasury yields, and major stock indices continues to shape precious metals performance. As the dollar weakened, gold and silver prices surged, yet the relationship between the two metals remained influenced by distinct market forces, particularly industrial demand for silver.

Retail and ETF Investment Trends

Exchange-Traded Funds (ETFs) saw an influx of 115 tonnes of gold in April, highlighting significant retail investment interest. Asia led net inflows, showcasing a dynamic shift in investment patterns and the growing willingness of retail investors to engage in precious metals amid global uncertainty.

Silver Market Dynamics

While silver initially faced a sharp decline of 18% in early April, aggressive bargain hunting led to a recovery, pushing prices back over the $32 mark. Interestingly, silver’s performance lagged behind gold, reflected in the widening gold-to-silver ratio. Additionally, external factors such as energy supply disruptions in Spain had repercussions on the silver market, drawing attention to the interdependencies within global resources.

Platinum and Palladium: Performance Metrics

Both platinum and palladium prices experienced similar movements, largely influenced by updates to tariff policies and shifts in investor sentiment. As tariffs began to show signs of de-escalation, trading volumes spiked, allowing these markets to stabilize amidst earlier declines. The correlation between platinum and palladium intensified, indicating that external pressures are impacting both metals similarly.

CFTC Positions

Tracking Managed Money positions on COMEX provides further insights into market sentiment. Liquidation in the silver space contributed heavily to earlier price declines, while subsequent bargain hunting reestablished some stability toward the month’s end.

Outlook for Precious Metals

As April closed, the dynamics within the precious metals market illustrated an intricate balance between supply, demand, and external economic influences. The resultant pressure from currency fluctuations, inflationary concerns, and geopolitical tensions will likely continue to steer market trends in the coming months.

In summary, the LBMA’s report for April 2025 casts a spotlight on the complex interplay of factors affecting gold, silver, platinum, and palladium markets. With ongoing uncertainties, investors remain vigilant as they navigate this volatile landscape, seeking refuge in precious metals as long-term assets.