Angel Oak Mortgage Reports Significant Growth in Q1 2025

Angel Oak Mortgage, a leading player in the financial services sector, has recently shared its financial performance for the first quarter of 2025. The results reflect a robust growth trajectory, highlighted by an impressive 18% surge in net interest income and an increase in book value.

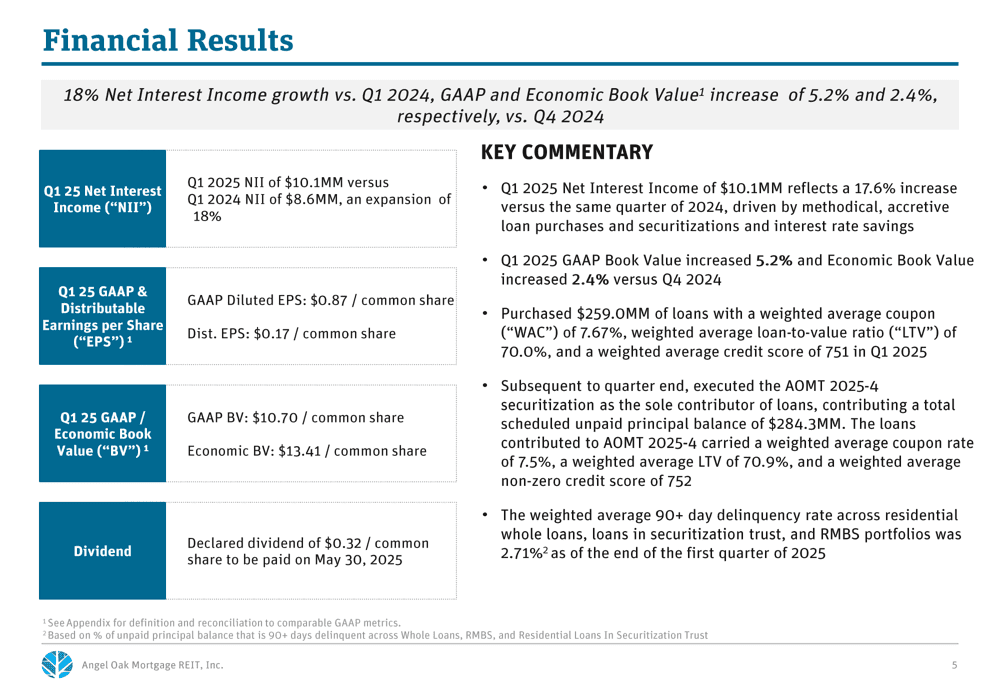

Key Financial Highlights

In Q1 2025, Angel Oak Mortgage experienced a notable rise in net interest income. This critical financial metric climbed 18%, indicating the company’s effective management of its loan portfolio and heightened earnings from its mortgage-related activities. Such performance not only underscores the strength of Angel Oak’s business model but also reflects its ability to adapt to changing market conditions.

The increase in net interest income can be attributed to various strategic efforts, including streamlined operations and enhancements in loan origination processes. By focusing on high-quality mortgage loans and efficient underwriting practices, Angel Oak has positioned itself favorably within the competitive landscape.

Book Value Growth

Additionally, the company reported a significant rise in its book value during the same period. This increase is a positive indicator of the firm’s financial health and stability, showcasing its potential for long-term profitability. The rise in book value suggests that the assets on Angel Oak’s balance sheet continue to grow in value, ultimately benefiting its shareholders and contributing to overall company strength.

Market Position and Strategy

Angel Oak Mortgage’s impressive performance is also a reflection of its strategic initiatives aimed at fortifying its market position. The firm has been focusing on diversifying its product offerings to meet the evolving needs of its customers. By investing in innovative mortgage solutions and enhancing customer service capabilities, Angel Oak has been able to attract a broader client base.

Moreover, the company’s commitment to leveraging technology has been pivotal. By adopting cutting-edge tools and digital platforms, Angel Oak has improved the efficiency of its operations, ultimately resulting in faster loan processing times and better customer experience.

Economic Context

The broader economic environment has also played a role in Angel Oak’s success. Favorable interest rates and a rising demand for mortgages have contributed to increased activity in the housing market. As consumers seek home financing options, Angel Oak Mortgage has effectively positioned itself to capture this demand.

The mortgage industry as a whole is experiencing a revitalization, thanks to low-interest rates that continue to attract new buyers. Angel Oak’s ability to capitalize on these trends has solidified its standing as a prominent mortgage provider. The firm is well-prepared to navigate the evolving landscape of the financial market, ensuring continued growth and profitability.

Future Outlook

Looking ahead, Angel Oak Mortgage is optimistic about sustaining its growth momentum. The company plans to implement further enhancements in its operational processes and continue its focus on innovation. By staying ahead of market trends and consumer preferences, Angel Oak aims to maintain its competitive edge in the mortgage industry.

Investments in advanced technology and customer relationship management systems will remain a priority. These initiatives are expected to strengthen the effectiveness of marketing campaigns and boost customer satisfaction levels, which are crucial for retaining existing clients and attracting new ones.

Conclusion

In summary, Angel Oak Mortgage’s Q1 2025 results reflect a successful period of growth characterized by significant increases in both net interest income and book value. The company’s strategic focus on improving operational efficiency and enhancing product offerings has reinforced its position in the competitive mortgage market. As favorable market conditions persist, Angel Oak Mortgage is well-equipped to achieve sustained success in the coming quarters.