Analyzing the Potential of ETFs: Focus on DGRW

In the world of investing, Exchange-Traded Funds (ETFs) have gained significant traction among individual and institutional investors. This article explores the performance of the WisdomTree U.S. Quality Dividend Growth Fund ETF (DGRW) and its underlying assets, highlighting potential growth opportunities based on analyst expectations.

Understanding DGRW

DGRW focuses on high-quality dividend growth stocks in the U.S. market. It seeks to provide investors with both capital appreciation and a reliable income stream through dividends. By examining the trading prices of DGRW’s underlying assets compared to analysts’ future price targets, we can better understand its potential for growth.

Current Price Analysis of DGRW

Currently, DGRW is trading at approximately $85.50 per unit. Analysts predict an average target price of $95.52 per unit over the next 12 months, indicating an expected upside of around 11.72%. This projection suggests that DGRW may present an attractive opportunity for investors looking for growth in dividend-paying equities.

Key Holdings and Upside Potential

Several underlying stocks within DGRW’s portfolio exhibit substantial upside potential relative to their respective analyst price targets. Here are some highlights:

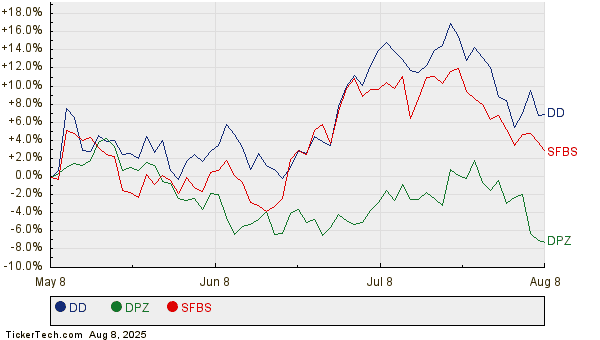

DuPont de Nemours Inc (DD)

DuPont de Nemours, recognized for its innovative technologies, is currently trading at $70.88 per share. Analysts have set a target price of $86.94, presenting a significant upside of 22.65%. This forecast indicates strong market confidence in the company’s future performance and growth prospects.

Domino’s Pizza Inc. (DPZ)

Domino’s Pizza, a leader in the quick-service restaurant sector, is presently priced at $442.42 per share. Analysts anticipate a reasonable upside of 15.61%, with a target price of $511.48. This reflection of consumer demand and operational efficiency suggests a solid outlook for the company.

ServisFirst Bancshares Inc (SFBS)

Trading at $76.69, ServisFirst Bancshares is expected to see its share price rise to an average target of $86.50. This projection represents a potential increase of about 12.79%. Analysts believe that the bank’s strong fundamentals and growth strategy will facilitate this ascension.

Table of Analyst Projections

The following table summarizes the key analyst projections for DGRW’s underlying holdings:

| Company Name | Symbol | Recent Price | Avg. Analyst Target | % Upside |

|---|---|---|---|---|

| WisdomTree U.S. Quality Dividend Growth Fund ETF | DGRW | $85.50 | $95.52 | 11.72% |

| DuPont de Nemours Inc | DD | $70.88 | $86.94 | 22.65% |

| Domino’s Pizza Inc. | DPZ | $442.42 | $511.48 | 15.61% |

| ServisFirst Bancshares Inc | SFBS | $76.69 | $86.50 | 12.79% |

Evaluating Analyst Forecasts

Understanding whether analyst predictions are well-founded or overly optimistic is crucial for making informed investment decisions. Investors must consider the context of these target prices and whether they reflect realistic assessments of company potential or outdated information.

While a higher target price signifies optimism, it can also lead to downward adjustments if the projections don’t align with market developments or company performance. Therefore, ongoing research and analysis are essential for accurate investment forecasting.

Conclusion

The potential upside of DGRW and its key holdings suggests opportunities for investors interested in the ETF space. As analysts provide their projections, it’s important for investors to conduct thorough due diligence and stay informed about market trends and company performance. By doing so, they can make strategic choices that align with their investment goals.