Diamondback Energy’s Q2 2025 Update: CAPEX Reductions and Production Goals

Diamondback Energy has recently shared its second-quarter update for 2025, highlighting significant adjustments in its capital expenditures while reaffirming its production objectives. This strategic approach aims to enhance profitability and operational efficiency.

CAPEX Reductions

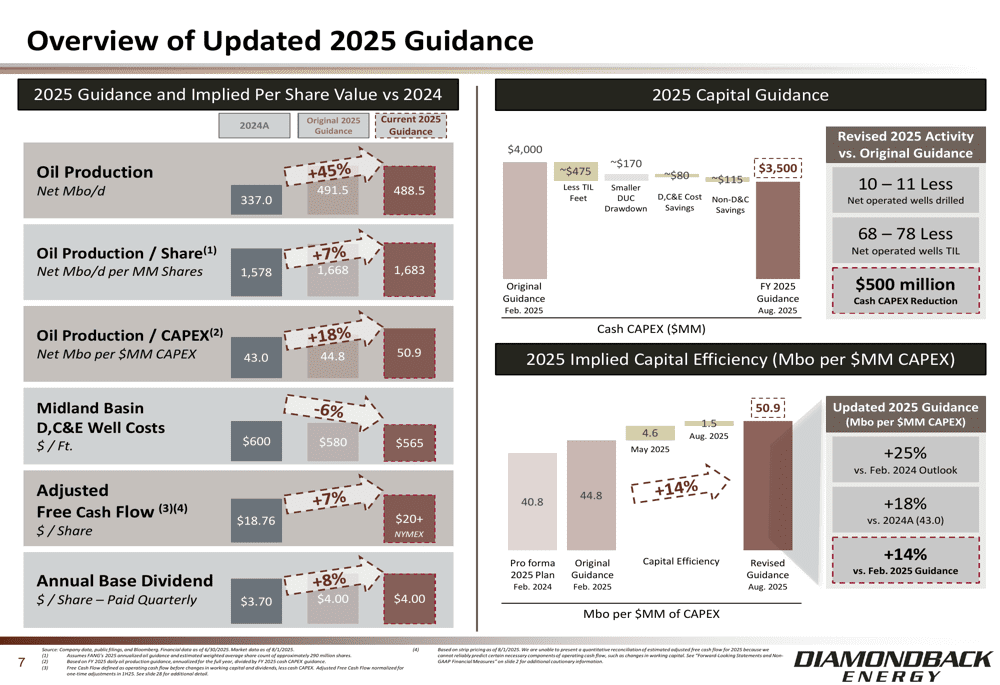

One of the most notable changes from Diamondback Energy’s latest report is the reduction in capital expenditures (CAPEX). The company has decided to decrease its CAPEX by $500 million. This adjustment reflects a broader trend in the energy sector where companies are increasingly focusing on cost management in response to fluctuating market conditions. By implementing this financial strategy, Diamondback Energy aims to optimize its spending while increasing shareholder value.

Production Targets

Despite the cut in CAPEX, Diamondback is committed to maintaining its production targets. The company’s leadership remains confident in its operational capabilities and forecasts that it will continue to deliver strong performance. By balancing financial prudence with production goals, Diamondback Energy aims to sustain its position as a leader in the energy sector while adapting to changing market dynamics.

Market Context

The decision to adjust CAPEX is influenced by the current economic climate, particularly the volatility in oil prices. Oil markets have witnessed shifts that necessitate a reevaluation of investment strategies. By reducing capital expenditures, Diamondback Energy can better navigate these uncertain conditions while ensuring that it remains competitive.

Financial Health

Maintaining a robust financial position is crucial for any energy company. Diamondback Energy’s strategy to lower CAPEX signals its intention to strengthen its balance sheet. The company has prioritized financial health to ensure that it can withstand fluctuations in the energy market while continuing to pursue growth opportunities. This focus will likely position Diamondback favorably in the long run.

Shareholder Returns

In addition to CAPEX reductions, Diamondback Energy continues to prioritize shareholder returns. The company’s management has committed to returning capital to shareholders through dividends and share repurchases. This commitment underlines the importance of delivering value to investors while navigating a challenging economic landscape.

Strategic Adjustments

Diamondback Energy’s adjustments are not merely reactive but part of a broader strategic initiative. The company is focused on enhancing operational efficiency, which includes optimizing drilling techniques and reducing production costs. These improvements are intended to provide sustainable competitive advantages and ensure that the company can adapt to future industry challenges.

Future Outlook

Looking ahead, Diamondback Energy remains optimistic about its growth prospects. The company’s leadership is focused on innovation and technological advancements that can enhance production and efficiency. This forward-thinking approach will be essential in navigating the complexities of the energy market and ensuring long-term sustainability.

Commitment to Sustainability

In line with industry trends, Diamondback Energy is also making strides toward sustainability. The company recognizes the importance of environmentally responsible practices in its operations. Implementing sustainable technologies not only aligns with regulatory expectations but can also improve public perception and open new market opportunities.

Conclusion

In summary, Diamondback Energy’s recent Q2 2025 update reflects a strategic approach that balances the need for cost reduction with ambitious production goals. By focusing on financial health, operational efficiency, and sustainability, Diamondback Energy is preparing itself for a dynamic future in the energy landscape. Through careful management of resources and a commitment to shareholder returns, the company aims to maintain its industry leadership while adapting to evolving market conditions.