Analyst Projections for the WisdomTree U.S. LargeCap Fund ETF

In analyzing the ETF landscape, we’ve focused on how the underlying assets of various ETFs are performing compared to expected future valuations. Our investigation highlights the WisdomTree U.S. LargeCap Fund ETF (Ticker: EPS), which has garnered attention among analysts.

Understanding Analyst Price Targets

For the WisdomTree U.S. LargeCap Fund ETF, the implied price target based on analyst assessments stands at $72.41 per share. Currently, EPS is trading at around $65.19 per share, suggesting a potential upside of approximately 11.07%. This figure indicates that analysts are optimistic about the ETF’s prospects over the next year.

Notable Holdings

Several key stocks within the ETF’s portfolio are contributing to this positive outlook. Here’s a look at three significant holdings:

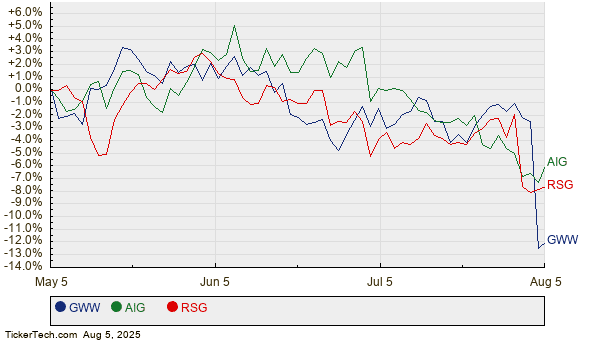

W.W. Grainger Inc. (Ticker: GWW): This stock is currently priced at $938.27 per share, but analysts have set an average target of $1,092.73, which represents a potential upside of 16.46%.

American International Group Inc (Ticker: AIG): AIG shares are trading at $78.29, with a target projected at $90.94, translating to a 16.15% upside.

- Republic Services Inc (Ticker: RSG): Currently trading at $231.71, RSG has an analyst target of $268.33, reflecting a 15.81% potential increase.

Performance Overview

The performance of these stocks can be visualized through historical data. Understanding the twelve-month price trends of GWW, AIG, and RSG helps investors gauge the overall health and potential growth of their investments.

Analyst Sentiments

The key question for investors is whether these price targets are sustainable or overly ambitious. Analysts often rely on a mix of quantitative data, such as earnings reports, and qualitative insights, such as market trends and economic conditions, to formulate these projections.

A significant price target that exceeds the current trading price could suggest confidence in the stock’s future. However, it’s essential to evaluate whether this optimism is backed by solid fundamentals. A disconnect between trading prices and targets might hint at potential adjustments in future forecasts.

Continuous Evaluation

Investors should continually assess market conditions and company developments, as these can greatly influence stock performance. Regular updates and revisions to analyst targets can provide further guidance for strategic investment decisions.

By remaining informed and understanding the reasons behind analyst expectations, investors can better navigate the complexities of the market and make more educated investment choices.

This content aims to provide readers with a clear view of the potential opportunities within the WisdomTree U.S. LargeCap Fund ETF while encouraging them to pursue further research and insights into the dynamic landscape of investments.