Evaluating the John Hancock Multifactor Mid Cap ETF and its Potential

Understanding Implied Analyst Target Prices

In analyzing exchange-traded funds (ETFs), it’s essential to look at their underlying components to assess potential performance. By comparing current trading prices of these assets against the projected analyst target prices over the next year, we can gain insights into the potential growth of the ETF itself.

For the John Hancock Multifactor Mid Cap ETF, denoted as JHMM, the average target price from analysts is calculated to be $69.99 per share. This figure is derived from examining individual stocks contained within the ETF.

Current Performance vs. Analyst Expectations

JHMM is currently trading around $62.17, which indicates that analysts foresee a potential upside of approximately 12.58% based on the underlying stocks’ target prices. This potential increase reflects market optimism and suggests that there’s room for growth in this ETF.

Highlights of Notable Holdings

Several stocks within the JHMM portfolio stand out due to their significant upside potential. Here are three key examples:

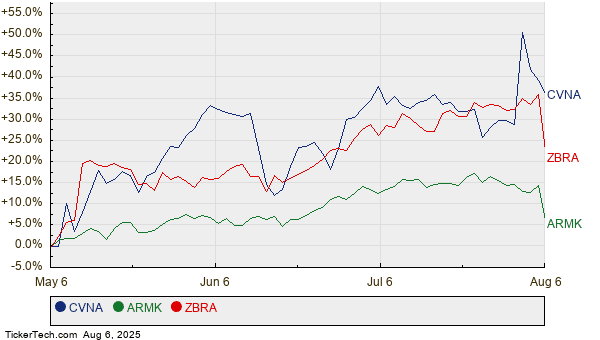

Carvana Co. (CVNA):

- Recent Price: $350.74

- Analyst Target: $398.83

- Upside Potential: 13.71%

Aramark (ARMK):

- Recent Price: $39.56

- Analyst Target: $44.96

- Upside Potential: 13.65%

- Zebra Technologies Corp. (ZBRA):

- Recent Price: $302.60

- Analyst Target: $342.29

- Upside Potential: 13.11%

These stocks not only contribute to the growth potential of JHMM but also highlight sectors that could see substantial performance improvements over the next year.

Analyzing Analyst Predictions

The question that arises is whether analysts are justified in their predictions or if they might be overly optimistic regarding future stock performances. High target prices can suggest confidence about a company’s trajectory; however, they may also lead to adjustments down the line if the market doesn’t align with those forecasts.

Investors should consider conducting further research into the underlying companies and their respective industries. Analyzing recent developments, market conditions, and company reports can provide deeper insights and help clarify whether the projected growth is realistic.

Summary of Key Analyst Targets

| Name | Symbol | Recent Price | Avg. Analyst Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Mid Cap ETF | JHMM | $62.17 | $69.99 | 12.58% |

| Carvana Co. | CVNA | $350.74 | $398.83 | 13.71% |

| Aramark | ARMK | $39.56 | $44.96 | 13.65% |

| Zebra Technologies Corp. | ZBRA | $302.60 | $342.29 | 13.11% |

Market Dynamics and Investment Research

When considering investments, understanding the dynamics of the market is crucial. Analysts’ expectations can provide a framework, but it is equally important to analyze the broader economic conditions that may impact stock performance. Potential investors should examine company fundamentals, industry trends, and macroeconomic indicators.

Doing your due diligence not only prepares you for making informed decisions but also helps in aligning your investment strategy with market realities.

By focusing on promising assets within the John Hancock Multifactor Mid Cap ETF and being mindful of overall market conditions, investors can better navigate their investment choices and understand potential risks and rewards.

Tools for Researching ETFs

Many resources exist for investors looking to delve deeper into ETFs and their underlying assets. From analytical platforms that offer insights on stock performance to websites dedicated to ETF metrics, utilizing various tools can enhance your investment strategy.

By leveraging available data, investors can make calculated decisions based on comprehensive information, rather than merely relying on speculation or isolated data points.

Investors are encouraged to continuously educate themselves and remain vigilant about market shifts that may impact their investments, especially in a dynamic environment where trends can change rapidly.

In conclusion, while the John Hancock Multifactor Mid Cap ETF, along with its notable holdings, may demonstrate strong growth potential, thorough analysis and market understanding will always be key in guiding investment decisions.