Midland States Bancorp Reports Positive Q2 2025 Results

Overview of Midland States Bancorp’s Performance

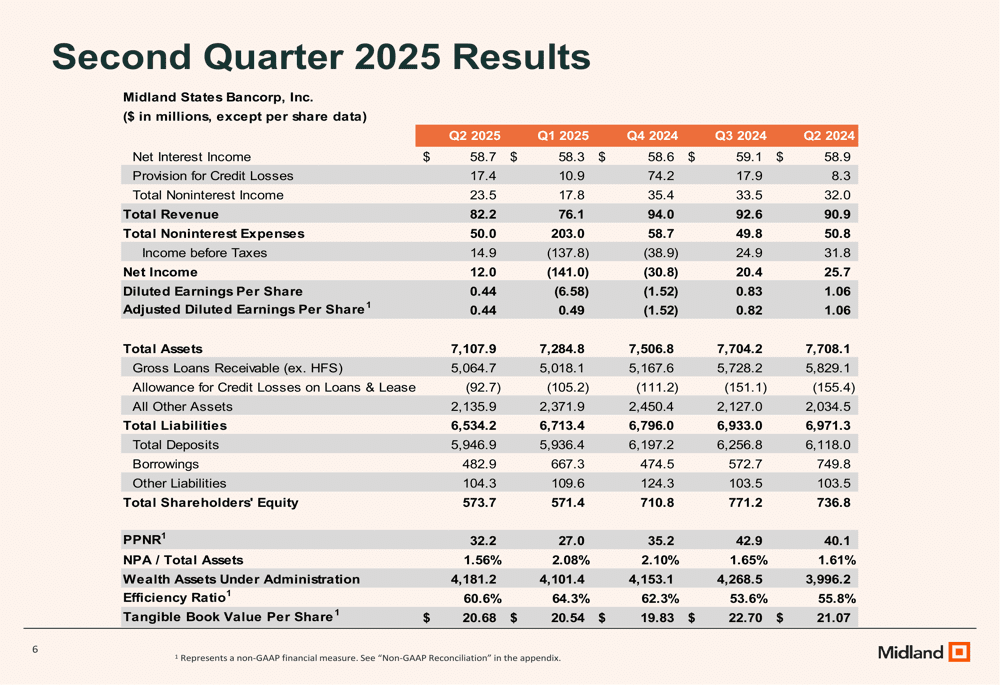

Midland States Bancorp has released its financial results for the second quarter of 2025, showcasing significant improvements in several key areas. The bank experienced a notable increase in earnings, driven primarily by enhancements in credit quality and an expanded net interest margin (NIM). This progress highlights the institution’s commitment to strengthening its financial health and providing valuable services to its customers.

Earnings Growth

In the second quarter of 2025, Midland States Bancorp reported impressive earnings. The institution’s proactive management strategies and focus on enhancing credit quality contributed to this growth in profits. The organization has made strides in balancing risk and fostering relationships with clients, leading to increased loan performance and reduced non-performing assets.

Credit Improvement

A significant factor in the bank’s strong performance is the improvement in its credit portfolio. Midland States Bancorp has effectively managed its assets, resulting in a decline in delinquency rates and overall credit losses. These enhancements reflect the bank’s diligent approach to risk assessment and management, giving stakeholders confidence in its long-term stability.

Expansion of Net Interest Margin

Another area of focus for Midland States Bancorp is the expansion of its net interest margin. The bank’s ability to increase its NIM demonstrates effective cost management and competitive lending policies. By optimizing its interest rate spread, Midland has positioned itself favorably within the financial landscape, allowing for greater profitability and the potential for further investment in growth initiatives.

Strategic Initiatives

Midland States Bancorp continues to pursue strategic initiatives aimed at enhancing customer satisfaction and service delivery. The bank’s commitment to innovation and technology plays a vital role in its strategy, allowing it to offer advanced banking solutions and streamline operations. By focusing on customer needs and implementing efficiency-enhancing measures, Midland aims to expand its market reach and solidify its position in the industry.

Community Engagement and Support

Community involvement remains a cornerstone of Midland States Bancorp’s philosophy. The bank actively engages with local organizations and initiatives, demonstrating its dedication to supporting the communities it serves. Through various outreach programs and financial education efforts, Midland seeks to empower individuals and promote economic growth in the areas where it operates.

Future Outlook

Looking ahead, Midland States Bancorp is well-positioned for continued success. The bank’s strategies to enhance credit quality and expand its net interest margin underscore its commitment to sustainable growth. By maintaining a strong focus on risk management and operational efficiency, Midland is equipped to navigate the evolving financial landscape.

Conclusion

In summary, Midland States Bancorp’s Q2 2025 results reflect a successful period marked by improved earnings, credit quality, and net interest margin expansion. The organization’s strategic initiatives and community-focused approach enhance its reputation and standing in the financial sector. As it prepares for the future, Midland remains dedicated to delivering exceptional service and value to its customers and communities.