Schneider Electric Stock Update

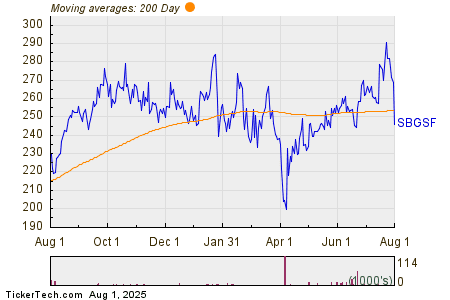

In the trading session on Friday, shares of Schneider Electric (Ticker: SBGSF) experienced a notable decline, falling below their 200-day moving average of $254.01. The stock reached a low of $245.32 per share, marking a decrease of approximately 8.1% for the day. This movement indicates a noteworthy shift in the stock’s performance.

Performance Analysis

Examining the performance of SBGSF over the past year provides additional context. The stock’s 52-week low stands at $200 per share, while the highest point over the same period is $295.05. In comparison, the most recent trading activity saw shares at $246.40, reflecting a significant drop from the high but still above the low marker.

Key Metrics and Insights

The fluctuations in Schneider Electric’s stock prices can be observed in the accompanying chart, illustrating the dynamics between its recent trading values and the 200-day moving average. Investors should take note of these metrics as they assess the stock’s trajectory and potential future performance.

Market Sentiment

Market reactions to a stock crossing below its moving average can compound investor anxiety. This trend often signals the need for a deeper examination of the factors influencing stock performance, including broader market trends, company developments, and economic indicators.

Understanding how these elements interact can help investors make informed decisions moving forward. Whether this drop is a temporary setback or indicative of a longer-term trend remains a point of interest.

Trading Insights

For those tracking stock performance, it’s crucial to identify other stocks that may have also recently crossed below their 200-day moving average. This can provide a comparative view and possibly highlight investment opportunities or alert investors to emerging risks.

By keeping an eye on the overall sector and similar stocks, investors can enrich their market perspective, allowing for more strategic decision-making in the face of fluctuating stock prices.

This information serves as a snapshot of the current state of Schneider Electric’s stock performance and should be considered alongside other financial analyses and market conditions.