- Last week, cryptocurrency prices fluctuated within a set range as market interest took a back seat due to ongoing economic uncertainties.

- Exchange-traded fund (ETF) inflows were negative, with Bitcoin ETFs experiencing net outflows of $62.9 million and Ethereum ETFs facing $8.9 million in outflows.

Bitcoin

Bitcoin’s price movement remained range-bound, recording weekly highs and lows of $99,509 and $93,331, respectively, amidst concerns about inflation, US President Donald Trump’s policies, and geopolitical developments.

Taking a broader view, the price has been hovering around the daily support level for the past three weeks, as current market conditions lack the necessary catalysts to drive prices to new heights.

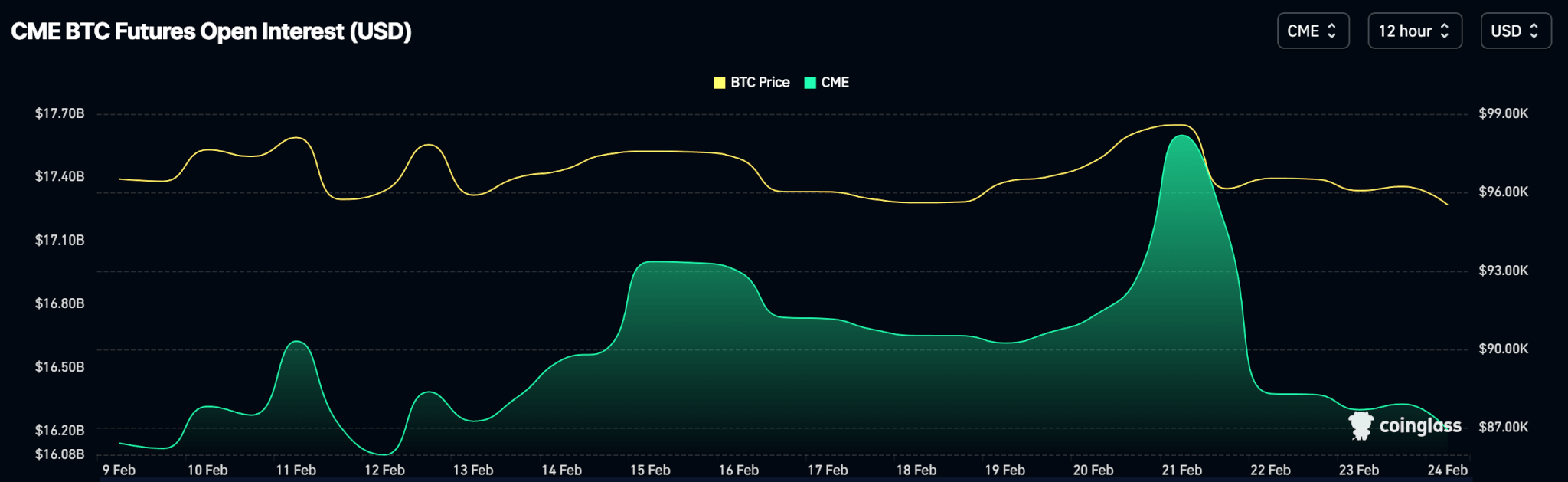

Open interest reflected this price action, beginning the week with decreased open contract volumes, which rose again on Wednesday, February 19, in line with price movements.

Outlook

For Bitcoin to remain in bullish territory, it must stay above the daily support level of $90,673. A daily close below this threshold could lead to a decline towards the $84,000 mark.

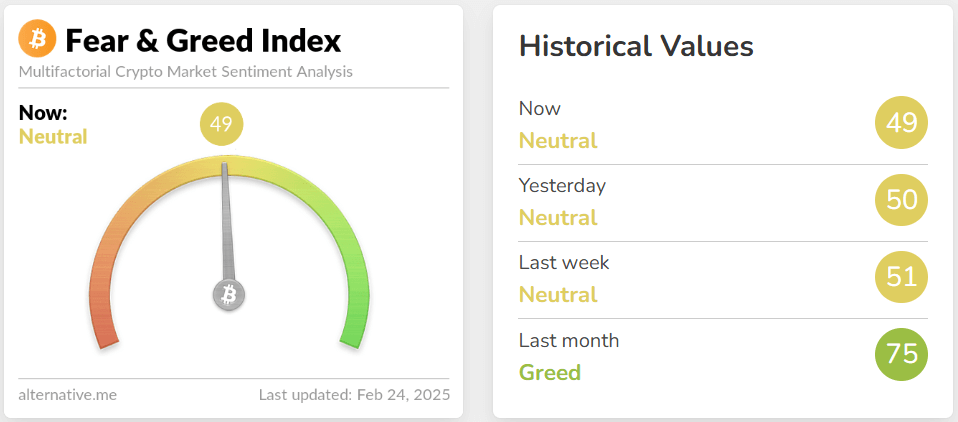

At the same time, market sentiment has significantly cooled over the past month, entering a neutral phase.

As of publication, Bitcoin is trading at $87,900.

Ethereum

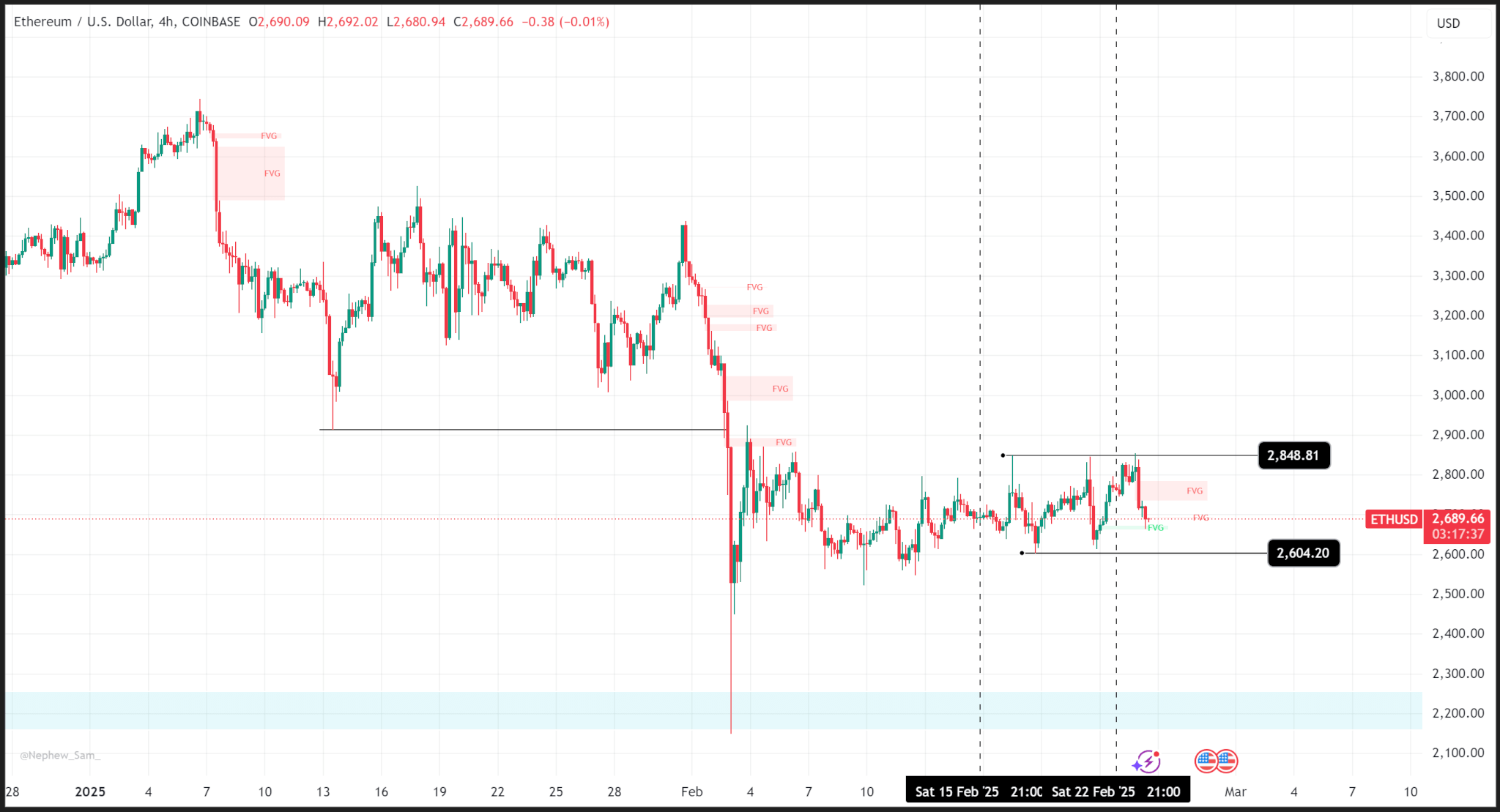

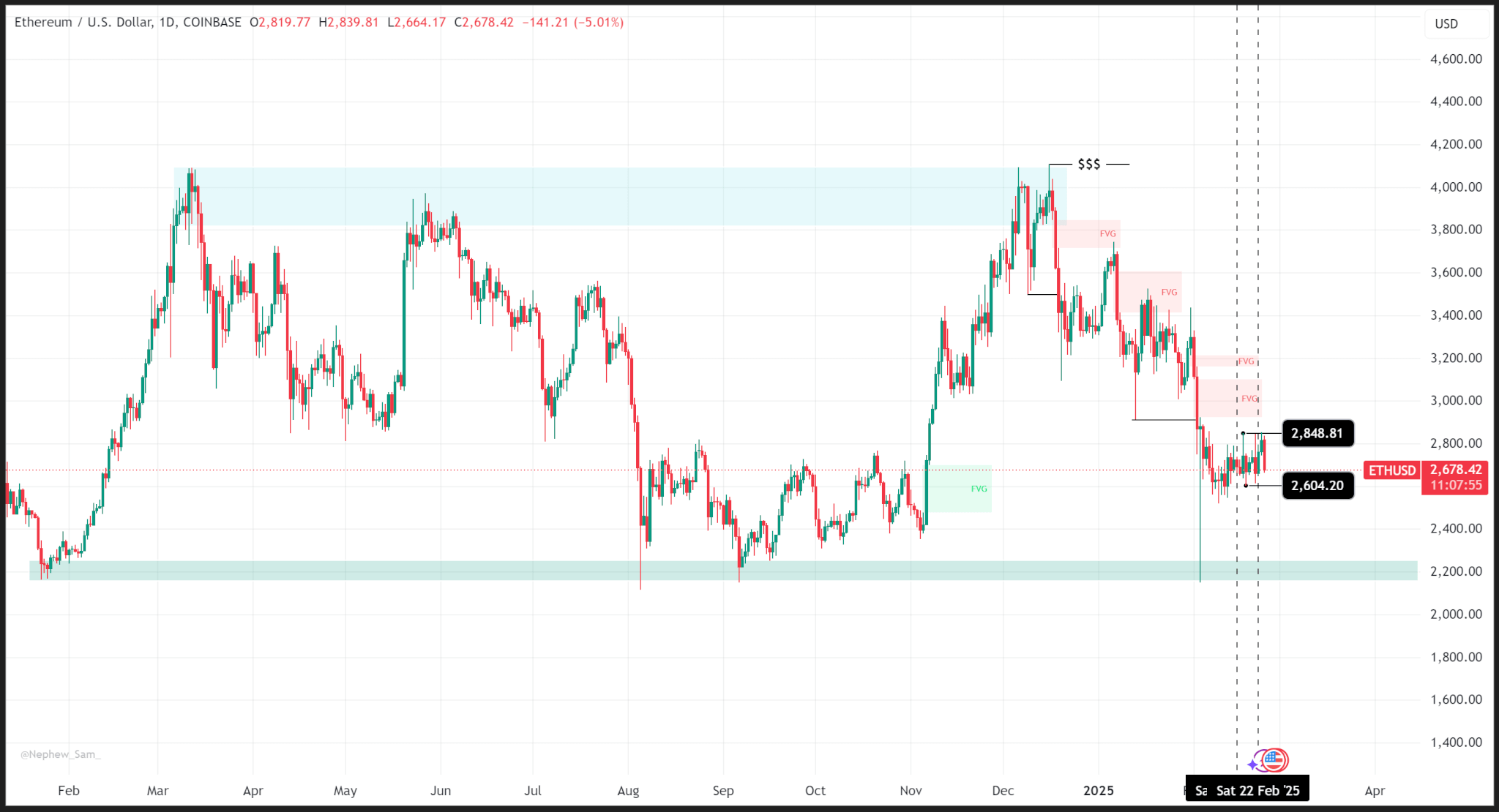

Ethereum’s price witnessed fluctuations last week, achieving a weekly high of $2,848 and a low of $2,604, despite the recent news surrounding the Bybit hack.

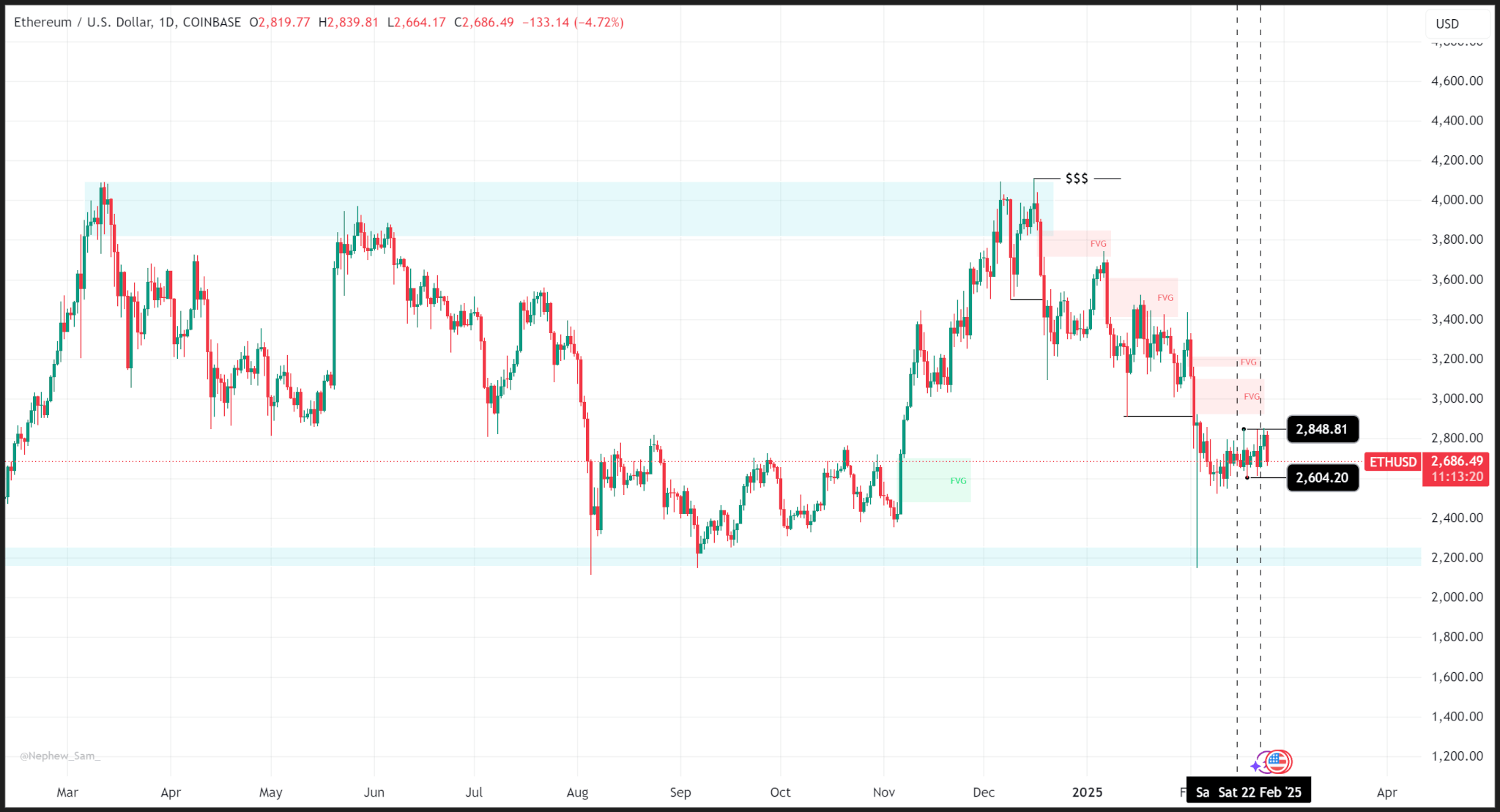

Looking at the larger picture, it appears less optimistic as ETH has seen a downward trend since December 09, following its failure to surpass the peak from March 2024.

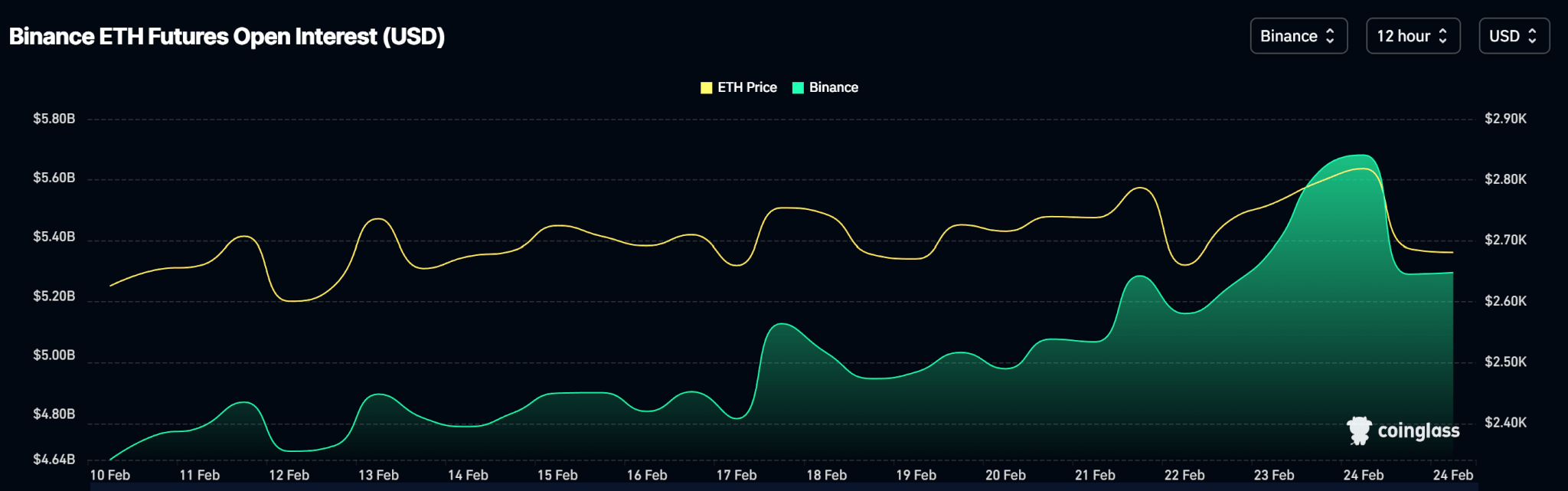

The open interest data indicates a consistent increase in contract volume throughout the week, despite the price remaining range-bound.

Outlook

The upcoming major support zone for ETH is expected to be around the $2,500 mark, which has historically served as a strong liquidity level.

At the time of publication, ETH is trading at $2,384.

Solana

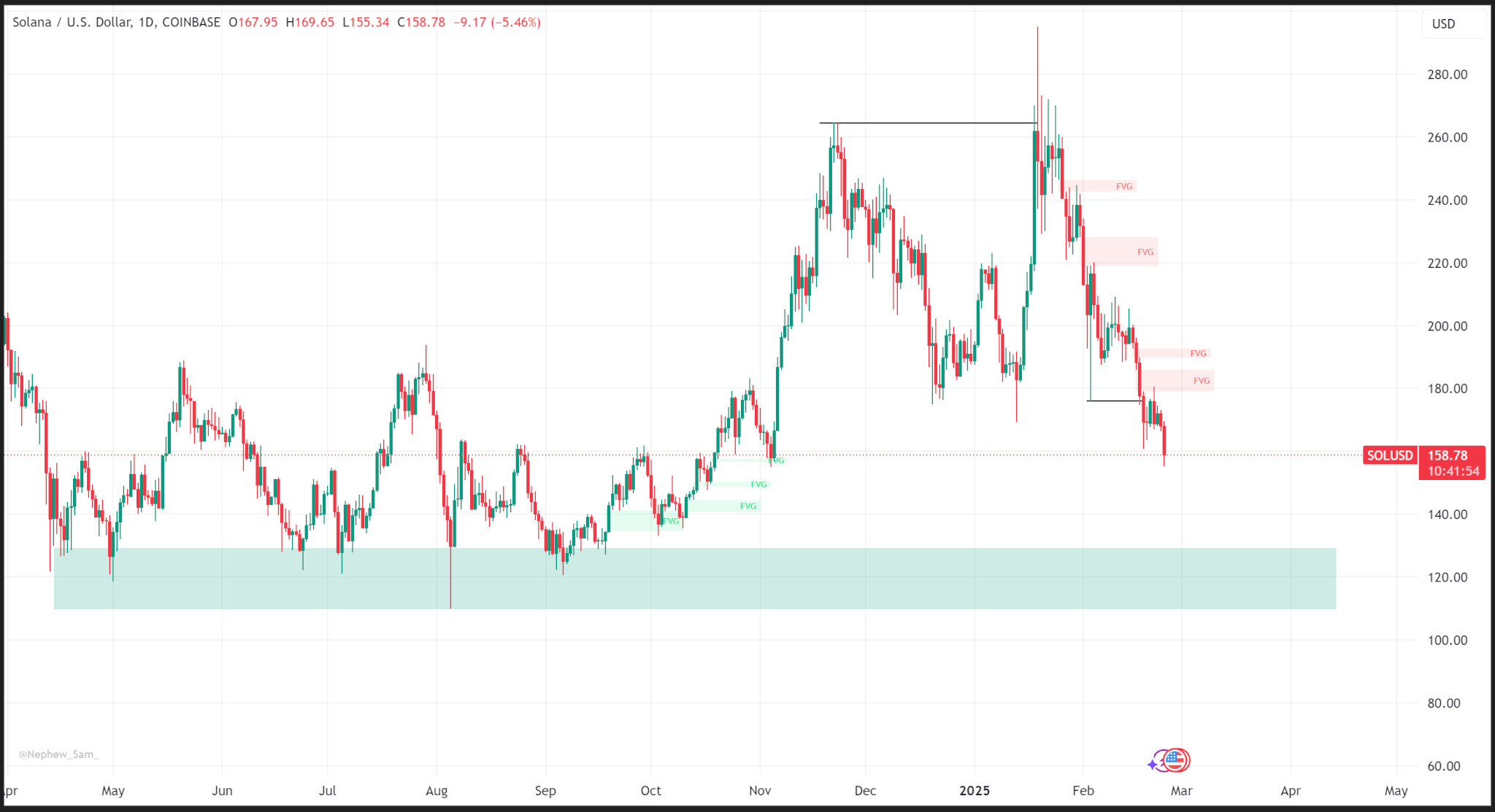

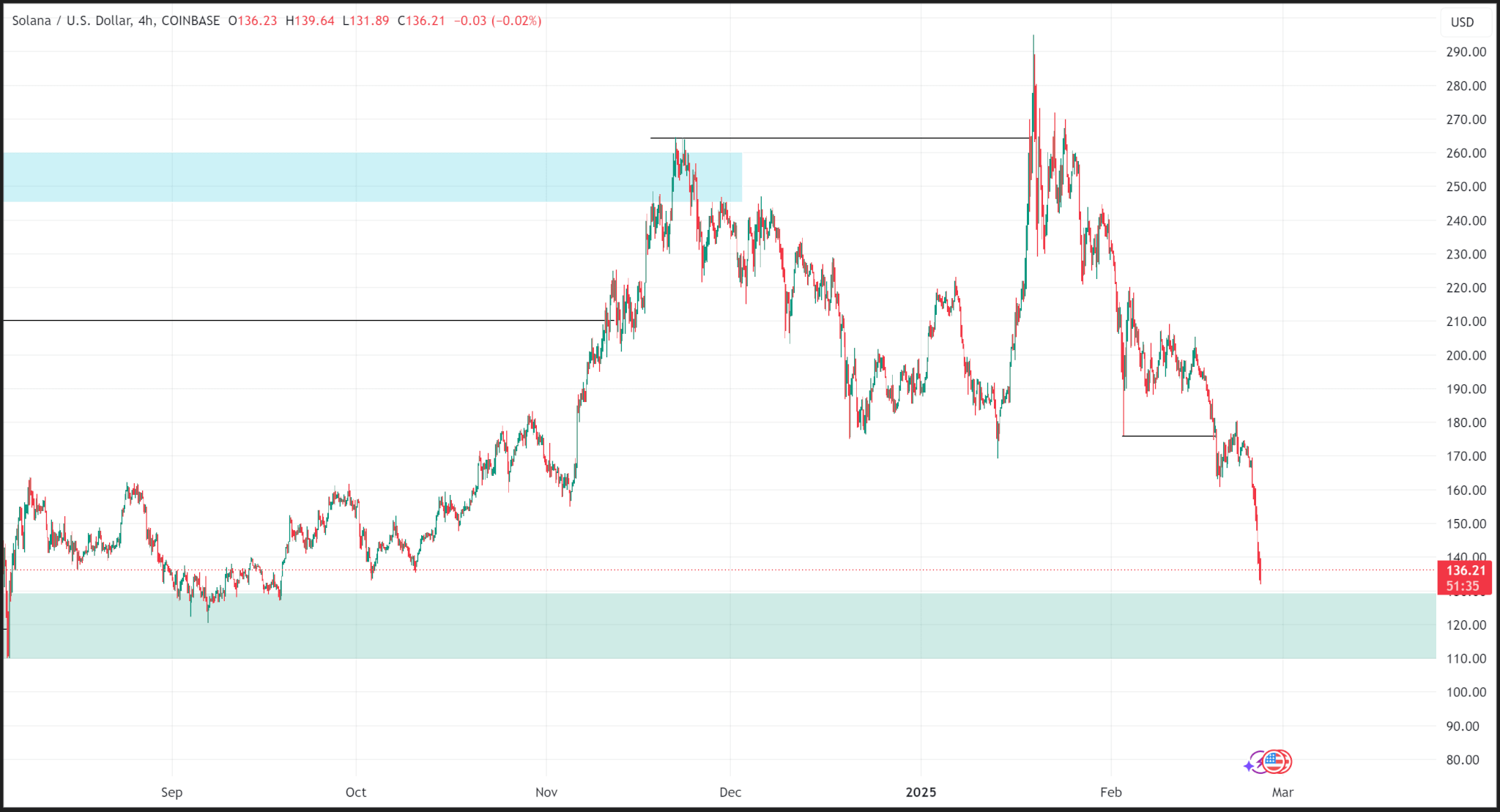

In a similar pattern to Ethereum, Solana’s price has experienced a decline since it was unable to gain momentum and create new candles above the previous all-time high on the daily chart.

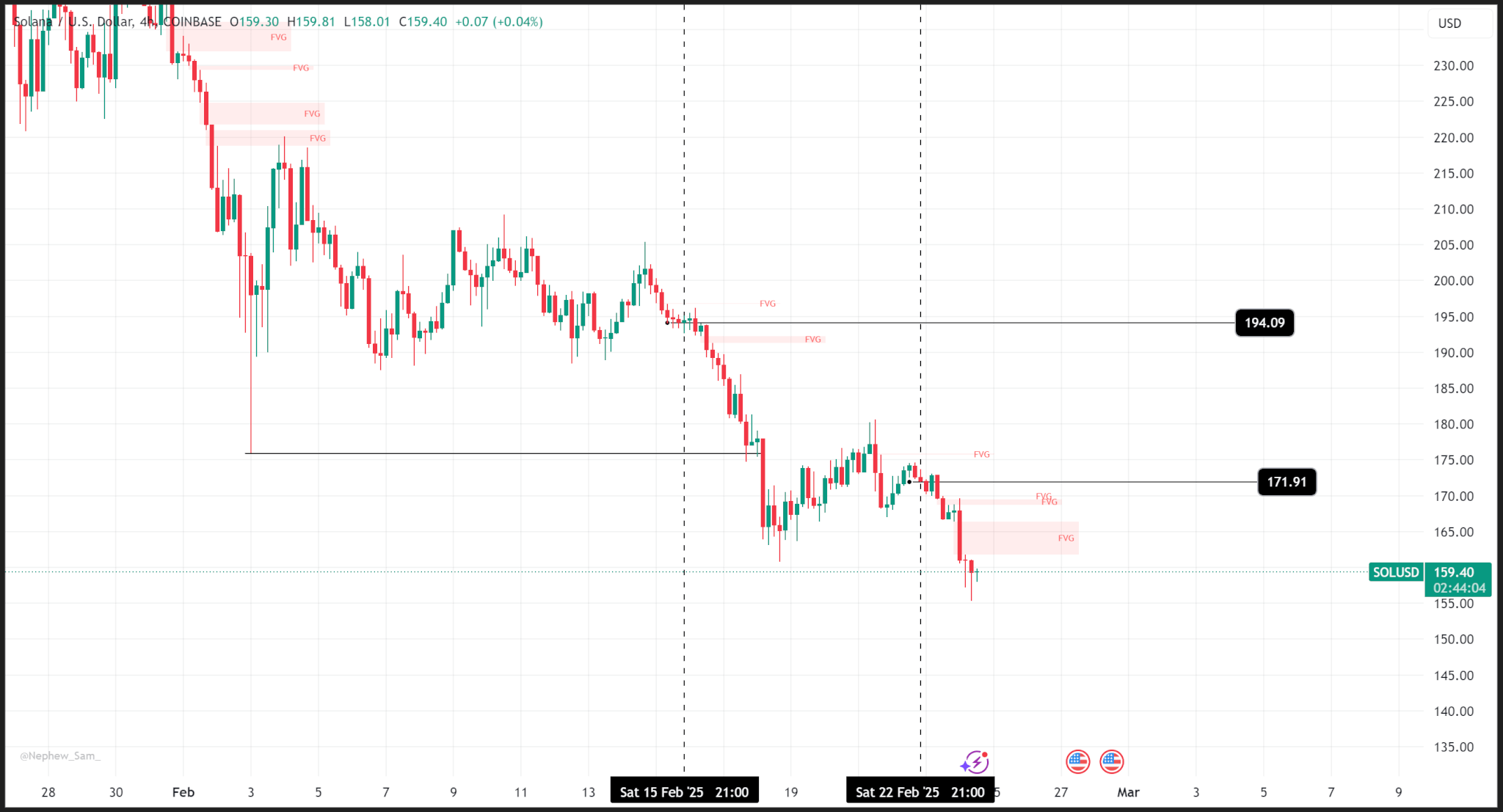

In contrast to Ethereum, last week Solana’s price action was bearish, dropping from a weekly open of around $194 to a close near $171.

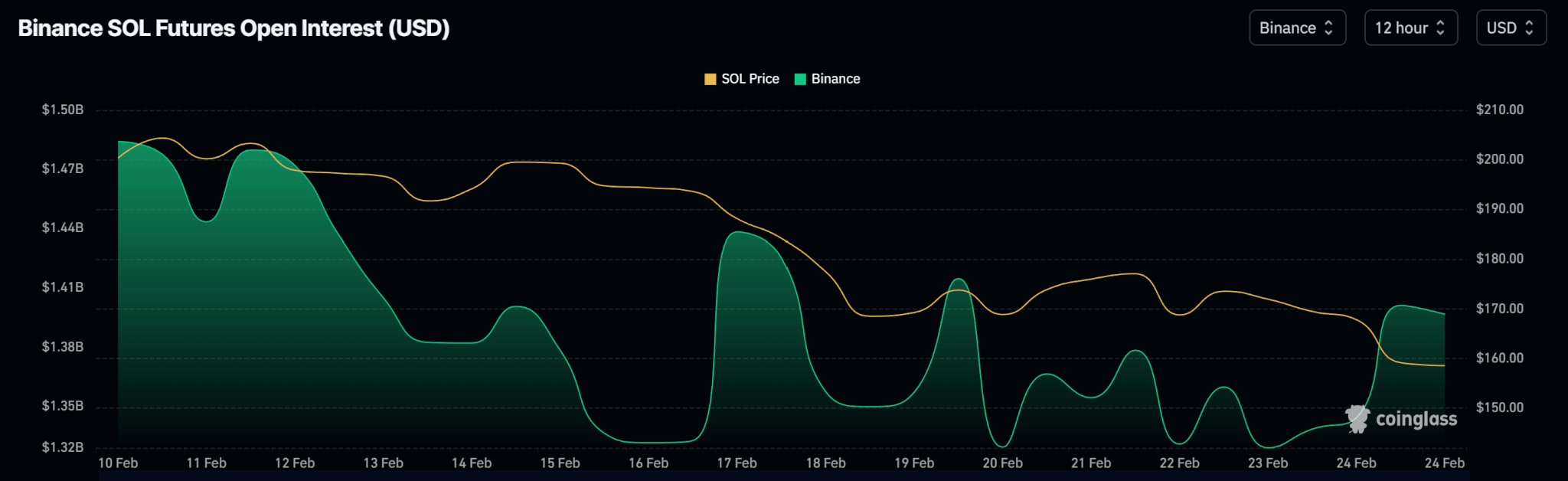

Open interest trends exhibit erratic movements in open contract volumes as the price declines.

Outlook

Solana’s next significant support zone is anticipated to be at the $129 level. However, we may witness smaller rallies as the overall price trend continues to decline.

This article on Weekly price analysis: prices range on uncertain economic outlook first appeared on CoinJournal.

Last week in the cryptocurrency market saw prices trading within a constrained range amid broader economic uncertainties that have led to diminished market enthusiasm. Notably, exchange-traded funds (ETFs) experienced negative inflows, with Bitcoin ETFs registering net outflows of $62.9 million and Ethereum ETFs seeing outflows of $8.9 million. This context of economic hesitance has resulted in a lack of catalysts to push crypto prices higher.

Bitcoin Analysis

Bitcoin’s price remained rangebound, fluctuating between a weekly high of $99,509 and a low of $93,331. Contributing to this volatility are concerns regarding inflation, political factors such as policies from U.S. President Donald Trump, and various geopolitical events. Over the last three weeks, Bitcoin prices have been clinging to a daily support level, indicating an inability to generate momentum for a breakout.

Open interest—a measure of market sentiment—paralleled this price action. At the week’s onset, a reduction in the volume of open contracts was observed, followed by an increase on February 19, aligning with swings in price. Currently, Bitcoin needs to maintain its position above a crucial support level at $90,673 to remain in bullish territory. If it closes below this threshold, a decline toward the $84,000 mark could ensue. As of publication, Bitcoin is trading around $87,900, reflecting a cooling sentiment that places it in neutral territory.

Ethereum Analysis

Ethereum also exhibited trading within a range last week, hitting a high of $2,848 and a low of $2,604, despite the unfavorable news surrounding a hack on Bybit. The larger trend for Ethereum appears bearish, having fallen consistently since it failed to ascend beyond its March 2024 high. An analysis of open interest reveals a steady increase in contract volumes throughout the week, although prices remained rangebound, indicating a possible buildup of positions among traders.

For Ethereum, the next significant support level is projected around $2,500, a zone that has historically acted as a strong liquidity attractor. Currently, Ethereum is trading at $2,384, suggesting challenges in making upwards progress.

Solana Analysis

Solana has also faced a downturn, with its price failing to rally above the previous all-time high on the daily timeframe. Last week, Solana’s price showed a bearish trend, dropping from an opening around $194 to a closing price of approximately $171. The open interest data for Solana displayed erratic movements, reflecting volatility and uncertainty among traders as prices declined.

The next major support level for Solana is anticipated at $129. Despite the overall downtrend, smaller rallies may occur as the price seeks to stabilize but any substantial recovery remains elusive.

In summary, the cryptocurrency market is experiencing a significant lack of bullish momentum, driven heavily by economic uncertainties and negative ETF inflows, affecting major players like Bitcoin, Ethereum, and Solana. Each asset is probing critical support levels to maintain bullish prospects, but signs point to potential declines if current conditions persist. Bitcoin remains a focal point, while attention also shifts toward Ethereum’s historical liquidity zones and Solana’s struggle to maintain interest amidst declining prices. The market’s overall sentiment remains cautious, with cryptocurrency trading likely to continue being influenced by external economic factors in the near term.