West Bancorporation Reports Impressive Q2 2025 Results

Overview of Financial Performance

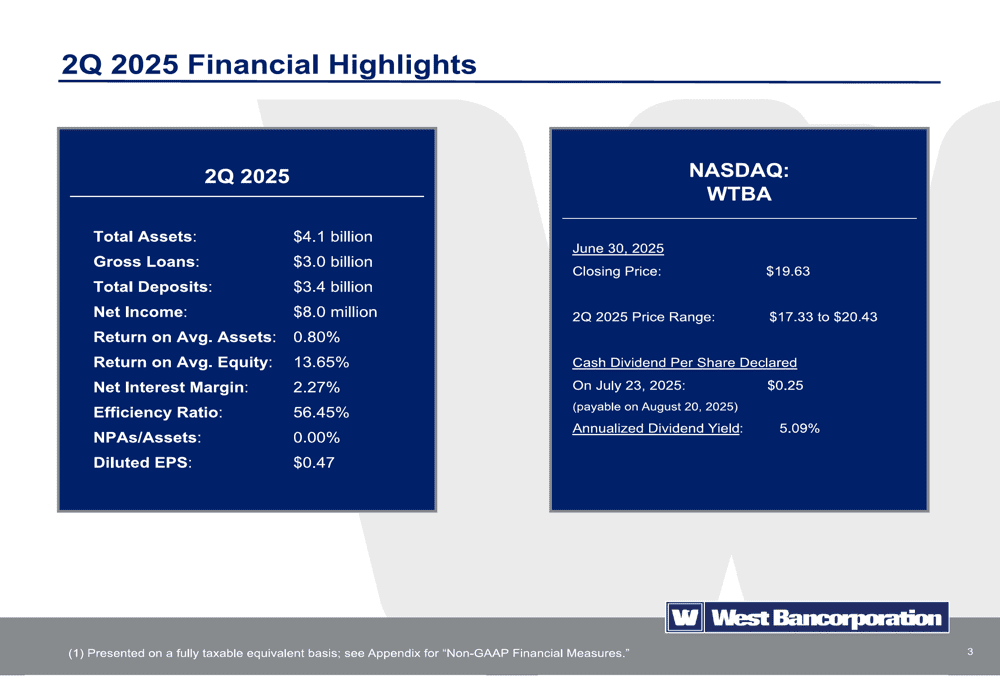

West Bancorporation announced a remarkable increase in net income for the second quarter of 2025, showcasing a 54% year-over-year growth. This surge highlights the company’s strong financial health and effective management strategies, positioning it favorably within the banking sector.

Key Highlights of Q2 2025

During this quarter, West Bancorporation experienced significant advancements, particularly in credit quality. The bank reported a decreased rate of non-performing loans, demonstrating its commitment to prudent lending practices. As a result, the overall asset quality has improved, which is critical for maintaining investor confidence and long-term stability.

Strong Net Income Growth

Net income growth is a crucial metric for assessing a bank’s profitability. West Bancorporation’s impressive 54% increase can be attributed to several factors, including rising interest rates, increased lending volume, and strategic cost management. These elements combined have enabled the bank to enhance its earnings substantially, providing solid returns for shareholders.

Enhanced Credit Quality Metrics

In terms of credit quality, West Bancorporation has outperformed expectations. The bank reported a notable decrease in the percentage of non-performing assets, reflecting its rigorous underwriting standards and proactive risk management. This improvement not only benefits the institution but also reinforces trust among customers and investors alike.

Revenue Composition

West Bancorporation’s revenue streams diversified during the second quarter. The growth in net interest income significantly contributed to the overall revenue, resulting from the higher interest rates set by the Federal Reserve. Additionally, non-interest income from service fees and other sources also increased, providing a balanced approach to revenue generation amidst changing market conditions.

Outlook for Future Growth

Looking ahead, West Bancorporation is optimistic about its growth trajectory. Management anticipates continued strong performance in both net income and credit quality. The bank is well-prepared to navigate potential economic fluctuations, thanks to its solid capital position and resilient business model.

Market Positioning

With these impressive quarterly results, West Bancorporation has strengthened its market position. Investors are now more inclined to consider this bank as a viable option due to its robust financial fundamentals. The ongoing focus on improving customer services and expanding its market reach will likely contribute to sustained growth.

Customer-Centric Strategies

West Bancorporation emphasizes a customer-first approach, which plays a crucial role in its overall success. By investing in technology and enhancing service delivery, the bank aims to improve customer satisfaction and engagement. This strategy is essential for retaining existing customers while attracting new ones, further supporting growth in revenue and market share.

Regulatory Compliance

Regulatory compliance remains a key factor for West Bancorporation. The institution adheres to all necessary guidelines to ensure operational efficiency and safeguard against risks. This commitment to compliance not only protects the bank but also enhances its reputation in the financial community.

Technological Advancements

In an era increasingly dominated by digital transactions, West Bancorporation is keen on integrating technology into its services. The bank has made significant investments in digital platforms to enhance customer experience and streamline operations. By prioritizing digital transformation, West Bancorporation is not only meeting current customer expectations but also positioning itself for future growth.

Commitment to Community Investment

West Bancorporation’s commitment to community investment is evident through its various initiatives aimed at supporting local growth. The bank actively participates in funding projects that drive economic development in its operational areas. This dedication fosters a positive relationship with the communities it serves, reinforcing the bank’s brand image and trustworthiness.

Conclusion

West Bancorporation’s outstanding performance in Q2 2025, characterized by significant net income growth and strong credit quality, showcases its effective management and strategic initiatives. By focusing on customer satisfaction, technological advancement, and community involvement, the bank is well-equipped to sustain its growth trajectory in the competitive financial landscape.